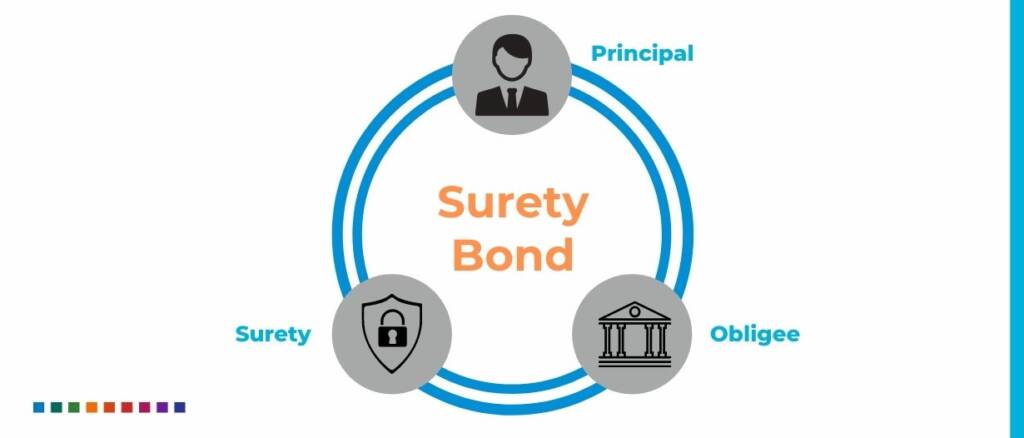

Surety bonding agencies are responsible for providing companies with legally-binding protection that can help protect their business from potential financial losses. A surety bond is essentially a third-party guarantee that a business will meet its contractual obligations. This type of protection is important for businesses, as it helps to ensure that if a contract is broken due to negligence or fraud, the surety bond will cover the resulting costs.

Surety bond companies provides protection against financial losses due to a breach of contract. This type of protection is especially beneficial to businesses that are in highly regulated industries, such as construction, finance, and transportation. Without surety bonding, businesses in these industries are at greater risk of suffering significant losses due to a breach of contract.

Image Source: Google

The surety bonding process is relatively simple. A company will first need to determine which type of bond they need. Depending on the size of the company and the industry in which they operate, the bond type may vary. Once the bond type has been determined, the company will need to secure the bond by paying a premium to the surety bonding agency. The surety bonding agency will then issue the bond to the company, which will provide them with the legal protection they need.

In addition to providing protection for companies, surety bonding agencies also provide education and assistance to businesses. They can help to ensure that businesses are aware of their legal responsibilities and provide advice on how to best protect their business from potential financial losses.

These agencies are a valuable resource for businesses that need legal protection from potential financial losses. By providing companies with legally-binding protection, surety bonding agencies help to ensure that businesses are adequately protected in the event of a breach of contract.

Surety bonding agencies provide businesses with the legal protection they need to protect their business from potential financial losses. By providing education and assistance, surety bonding agencies can help to ensure that businesses are aware of their legal responsibilities and provide advice on how to protect their business from potential financial losses.